Butwal: In the current fiscal year 2078/79 BS, the Lumbini state government has also brought private electric vehicles under the tax net. In the financial ordinance issued by the state government, tax has been provided for vehicles from electric scooters, motorcycles, cars to microbuses.

Although the tax rate of other vehicles was mentioned in the Economic Act of the last fiscal year, electric vehicles were not mentioned. For the first time this year, electric private vehicles have been brought under the tax net, said Tulsiram Adhikari, an official at the Ministry of Internal Affairs and Law. So far, no tax has been levied on private electric vehicles from the state. It has been kept from this year. ' He said, "It has been included in the Economic Act to encourage electric vehicles and increase the tax range."

Although the electric motorcycle was registered at the Lumbini State Transportation Management Office, it had not yet paid the tax. In the last fiscal year 2077/78, 120 two-wheeled electric vehicles have been registered at the Transport Management Office in Manigram. Some of them are motorcycles and many are scooters.

However, no tax has been collected from them so far, said Krishna Panthi, head of the office. "They have just been registered. Taxes could not be collected due to a lack of law. Now it should be taken after the law is made. ' He said. Electric cars registered in Kathmandu were taxed by the Transportation Management Office here. According to the Bagmati system, electric vehicles are taxed at a 25 percent discount. Due to the lack of charging stations, electric motorcycles and cars have not yet become the choice of consumers.

According to an economic ordinance issued by the Lumbini government, the tax rate on private electric vehicles is relatively low. There is an annual tax of only Rs 1,500 to Rs 3,000 for using electric motorcycles and scooters. But the tax for a two-wheeler powered by petrol up to 125 cc is Rs 2,500 annually. There are 20,000 motorcycles with more than 400 cc.

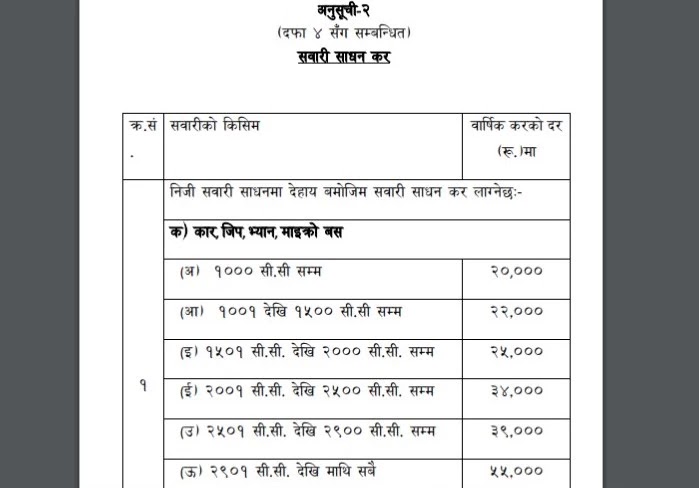

The annual tax on electric cars and jeeps ranges from Rs 15,000 to Rs 30,000. But the vehicle has to pay Rs 20,000 to Rs 55,000 depending on the capacity.

Annual tax payable by private electric vehicle